Textiles play an important role in the home space. This includes almost all fabric products: for the kitchen (pot holders, tea towels, tablecloths), living room (decorative pillows and covers, blankets, carpets), bedroom (bed linen, bedspread) and bathroom (towels, bath mats, bathrobes).

We will talk about the main types of textiles and the most relevant materials with which you can competently decorate your interior.

Types of textiles

The concept of “textile” comes from the Latin word textere, which means “interlacing of threads”. It is in this way, with the help of weaving machines, that fabric is produced.

Textiles obtained by weaving can be divided into four large groups: natural, artificial, chemical and mixed. This division depends on the composition of the fibers and threads.

| Natural | Synthetic | Artificial | Mixed | |

| Compound | natural fibers | 100% chemically produced threads | threads consist of natural raw materials, but are created chemically | combination of natural/synthetic/artificial threads |

| Fabric examples | linen, cotton, wool, silk | polyester, nylon, nylon, lavsan, polyester | acetate, viscose | wool textiles with added cotton |

| Advantages | - the material allows air to pass through well - not electrified | - durable material - does not lose color brightness | - elasticity - light shine | additional threads in the composition can improve the properties of the fabric. For example, woolen fabric with the addition of cotton fibers becomes softer |

| Flaws | - in sunlight they lose strength and brightness of color -linen, silk and some types of cotton and wool have a high price | - causes allergic reactions - creates a greenhouse effect - electrifies - attracts dust and household dirt faster | - loses strength after washing - may fade in the sun | depends on the specific composition of the product |

Main directions of economic use and processing of textile waste

- Obtaining regenerated fibers

- Obtaining regenerated wool

- Production of regenerated cotton, flax and chemical fibers

- Production of non-woven fabrics

- Cotton wool production

- Production of cleaning materials

- Tow production

- Production of building materials

What textiles are suitable for home

Let's talk about current natural textiles that are suitable for home interior design.

Cotton

Cotton is considered the most common textile fiber in the world, accounting for a significant share of all textile production - about 80%. The advantage of this material is a high level of quality, long service life and affordable price. The leading cotton producers are India, China and the USA.

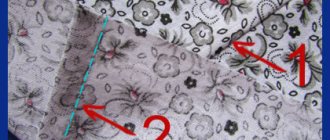

Thanks to the popularity of cotton, a variety of cotton fabrics with different weaves of fibers have appeared.

- Poplin

- thin, dense, very pleasant to the touch cotton fabric with a textured surface with a small rib. It is believed that the highest quality cotton poplin is produced in India. Since such textiles do not fade and withstand many washes (up to 200), color prints and designs are often applied to them.

- To produce percale

, the cotton thread does not twist, so the fabric is even and smooth. Despite all the lightness and softness, the fabric has a high density, holds its shape perfectly and retains heat: so, on percale bed linen you will not freeze, but you will not sweat either. Although the material can withstand up to 400 washes, it behaves very capriciously during cleaning - it is important to strictly follow the care instructions indicated on the label. As a rule, it costs more than other cotton fabrics.

- For children's textiles (diapers and bed linen), cotton is most often used. muslin

. Ultra-thin breathable fabric is distinguished by a plain weaving method: cotton threads are additionally twisted to give softness and smoothness. In addition to the fact that the lightweight material will not cause allergies, it will give the child comfort throughout the day.

- Satin

- dense durable textiles that retain their appearance for a long time. The softness and shine of the fabric is often compared to silk. Typically, cotton sateen is used for sewing bedspreads, bed linen and curtains. Satin can be woven from synthetic materials or silk, but a reasonable option in terms of price/quality is cotton textiles. The hypoallergenic material can withstand up to 400 washes without losing color and is easy to iron.

- Today velvet

used mainly for decorative textiles: furniture upholstery, bedspreads, decorative pillows and covers. Durable, pleasant to the touch material is easy to care for, retains heat well and, like all cotton fabrics, does not cause allergic reactions.

Wool

Animal hair is used to produce wool. For example, cashmere and mohair are made from the wool of mountain goats, alpaca is made from llamas, and angora is produced from the shearing of rabbits.

A common type of material in home textiles is merino wool.

. Sheep of the same breed have the finest fleece (for example, human hair is several times thicker). That is why the canvas is particularly soft, smooth and thin.

sheep wool is also especially popular on the market.

. Dense material is valued for its high strength and heat retention. But at the same time, textiles lack lightness and tactile smoothness, unlike the above types of wool.

The properties of textiles vary depending on its type, but some qualities remain unchanged - strength, softness, and most importantly - any wool retains heat perfectly.

Silk

Despite the thinness and lightness of the fabric, silk is much stronger than other types of fabrics. The material absorbs moisture well, dries quickly, and does not need to be ironed—if washed properly, the fabric retains its smoothness and shine. It also has excellent thermoregulating properties: thin silk will be a good option in cold weather, but in summer it will not create any discomfort - the temperature is regulated naturally, and the protein structure of the material is safe for allergy sufferers.

Textiles obtained from silkworm threads have only one important drawback - high price. That is why silk/semi-silk fabrics of various weaves are popular - dense flowing satin, textured crepe, chiffon and dupont, which is characterized by increased rigidity.

Linen

The modern trend towards environmental friendliness has made linen one of the most popular fabrics today. According to The Independent, searches for linen have increased by 46% since January 2021.

Linen is used everywhere in the interior today: from kitchen towels to bed linen. The key to such success is an endless list of properties: an environmentally friendly, completely recyclable material with high thermal conductivity and breathability. In addition, flax is a natural antiseptic. It has been proven that pathogenic microflora and fungal spores do not survive on it. Previously, flax was used for wound dressings; nowadays, surgical threads are made from it. This is why it is practical and sterile to use linen kitchen towels. Durable fabric is completely antistatic, hypoallergenic and can withstand more than 300 washes!

Home textiles include all fabric products that surround us indoors: from hand towels to sofa upholstery. Textiles can be natural, artificial (made from natural raw materials), synthetic or mixed (natural fibers + synthetic or artificial threads). When decorating the interior, give preference to natural fibers: cotton, wool, silk or linen.

Textile production market

General provisions

Textile industry is a group of light industry branches engaged in the processing of plant (cotton, flax , hemp, kenaf, jute, ramie), animal (wool, silk from silkworm cocoons), artificial and synthetic fibers into yarn, threads, and fabrics. Products produced by the textile industry (fiber, yarn and fabrics - the final product of the industry) serve as raw materials for other branches of light industry (clothing), and are also used in the manufacture of consumer goods, including non-woven materials. The main consumer of textile products is the clothing industry.

Global state of the textile industry

According to the World Trade Statistical Review 2016, prepared and published by the World Trade Organization (WTO), total global textile exports (excluding apparel) in 2015 amounted to US$291 billion (down 7.2% from than in 2014). The main exporters on the market remain China, the European Union and India. Their current combined share of global textile exports is 66.4%. The USA closed the top four in 2015. According to WTO data, at the end of the year, each of the TOP 10 global textile exporters reduced their volumes. The largest decline in 2015 was demonstrated by the European Union (-14%) and Turkey (-13%), the smallest losses to the 2014 level in the top ten were in China (-2%). However, yarn production practically remained at the level of a year ago. Comparing the decline in cross-border trade with the preservation of global textile production volumes, it can be assumed that the role of domestic sales has increased in the world market and the segment of synthetic fabrics has grown. According to the “Preferred Fiber Market Report 2016” prepared by Textile Exchange, the dominant source material in yarn production is polyester, whose share at the end of 2015 was 55%. This was twice the share of its closest competitor, cotton. This trend is expected to continue in the future.

The described trend is closely related to the active innovation process in the industry - the creation of “smart fabrics”, expanding the scope of textile use, can significantly reformat the current market configuration. The leaders in the development of smart textiles are the USA and Germany. In particular, a special scientific complex, Advanced Functional Fabrics of America (AFFOA), was created in North America. As prospects for the development of the area under consideration, access to the creation of technologies is indicated that allows tissue to independently restore damaged areas and be able to respond to external changes (change its structure in response to increased humidity or temperature changes), as well as store and convert energy, and much, much other. In particular, jointly by American and Chinese scientists, a “smart” hybrid fabric has already been developed that converts solar energy and mechanical movement into electricity. It consists of lightweight polymer “solar panel” fibers woven with triboelectric nanogenerators (TENGs).

Experts note that there is a growing demand on the market for technical textiles, which refers to fabrics and non-woven materials primarily made from synthetic fibers, used in almost all industries, including as auxiliary elements of production technology. In 2014, the market share of technical textiles reached 15% of the total volume of textile products produced in the world. This area is currently a priority for the US textile industry. Further confirmation of this is the fact that in 2021, the Department of Commerce International Trade Administration USA published the report “2016 Top Markets Report – Technical Textiles,” which presented promising areas for increasing exports of technical textiles from the United States.

In the second most important segment, the cotton segment, demand supports the direction of “Organic cotton” - this is cotton that is grown without the use of any chemicals (pesticides, insecticides, herbicides and other chemicals) and genetically modified cotton seeds. It is almost entirely collected and processed by hand, which, according to experts, allows not only to preserve the natural purity, but also to improve the quality of textile fibers. Today, the main producers of organic cotton are Türkiye, China and India. The demand for these products comes mainly from the most developed countries of the EU and the USA. It should also be noted that in developed countries there has long been a trend towards the development of technologies for the production of textiles from recycled materials. For the market, this means less dependence on raw materials and creates the preconditions for further price reductions.

The main exporters in the textile market for a long time have been China, the European Union and India. Their current joint share in world exports for the product group under consideration is 66.4%. The Russian textile market in terms of sales volume ranks second after the food market, and its volume in the Russian textile market is estimated at 275 billion rubles (2012 data). At the same time, the Russian textile market is not among the top regional markets in the world either in terms of production or consumption. Its most capacious segments are cotton and synthetic fabrics (their total share exceeds 80% of the total volume of the Russian market). The first of the mentioned segments has long been the leader in the consumption structure and had a low dependence on imports: mainly primary raw materials (raw cotton and cotton fiber) or gray fabrics (fabric without finishing and dyeing) are imported into Russia. However, the steady decline in the market for natural fabrics, with the replacement of their share by synthetic materials, fully affects the Russian market, where synthetic products also occupy an increasing share.

For Russia, the development of this area is of additional importance, since the country has developed oil production and oil refining complexes. In other words, Russia has initial competitive advantages for the development of synthetic textile production. The remaining share is divided between textile products made from flax and wool. There are minimal quantities of silk products on the market.

In general, the Russian market, even the segment of synthetic textiles, remains highly dependent on imports. According to the Higher School of Economics, at the end of 2015, 67% of the total capacity of the Russian synthetic fabric market was imported. In particular, in 2015, textile products (excluding clothing) worth about $3 billion were imported to Russia. Thus, in the global trade turnover for the product group under consideration, the share of the Russian market is only 1%. At the same time, imports occupy a more than significant share in the structure of the domestic market. This especially applies to synthetic and artificial fabrics, silk fabric and knitted fabric.

And Russia does not play a significant role as a textile exporter. In value terms, according to the Federal Customs Service of Russia, textile exports from Russia in 2021 amounted to $184.15 million. For comparison, according to UN Comtrade, a year earlier – in 2015 – the total export volume of yarn alone on the world market reached $52 billion. Global textile exports amounted to more than US$33 billion during the same period.

Data from the implementation of the Strategy for the Development of Light Industry in Russia for the period until 2021 and the Action Plan for its implementation, adopted in 2009, indicate that “the country’s mobilization needs for industry products are met by only 17–36%, which contradicts the legislation on state security, according to which the share of domestic production in the volume of strategic products must be at least 50%

State of the linen textile industry

This situation in Russia has developed since the second half of 2014 as a result of a significant technological lag in the textile industry, the high dependence of domestic producers on imported supplies of raw materials, such as cotton and cotton fiber, knitted fabric and synthetic fibers. There is also a noticeable trend towards a reduction in the traditional Russian production segment of linen yarn and linen fabrics .

In 2021, against the backdrop of significant government support measures, the market was able to show overall growth compared to the previous year. At the same time, the process of import substitution began actively, primarily affecting such segments as synthetic fabrics and knitted fabrics. In particular, if in 2014 the market share of knitted fabric of domestic products was 4%, then by the end of 2016 it had already reached 12%. But, as Rosstat data on the average annual production capacity of the main types of products by domestic textile enterprises testify, from 2010 to 2015 there was a significant reduction in the production capacity of yarn and fabrics from such natural materials, including flax . In other words, the growth of production capacity occurred only in the segment of production of fabrics from synthetic and artificial materials.

Among the reasons for the deterioration of the situation in the textile industry is the predominant position and development of shadow turnover of textile products, as well as “cargo transportation” of imported products by road trains and trains worth billions of dollars, not subject to taxes and duties (the mechanism was not spelled out in Russian legislation at that time levying duties and VAT on cargo transportation). This allowed importers to declare goods at deliberately reduced prices without indicating the quantity and range of imported products and to offer their products at dumping prices.

However, even taking into account the reduction in production capacity, there is a significant excess of it in relation to the actual production volumes. In particular, the existing production capacity for silk, wool and linen fabric is no more than a third loaded. The low rate of economic growth with the continued weakness of the national currency creates the preconditions for maintaining a low level of effective demand for textile products on the Russian market. First of all, this conclusion concerns consumer demand for the final product in the form of clothing and home textiles.

Demand for domestic textiles was formed due to targeted requests from state-dependent economic structures. The state of the Russian market for textile products is also in close connection with the process of scientific and technological progress and the introduction of innovations, including the expansion of the scope of textiles in addition to traditional linen and clothing - in construction, industry and other areas. Thus, with the decline in demand in the traditional market segment – the clothing market – the drivers of its support and even growth were the markets for technical textiles and workwear. The production of technical textiles in Russia increased 10 times by 2015, while almost all domestic technical textiles have a synthetic base.

In addition, at the turn of 2008–2009, a model finally emerged in which the Russian textile industry acted as a player primarily in the lower price segment of the domestic market, where it had to experience fierce competition from cheap imports from the countries of the Asia-Pacific region. Since the textile production industry is directly dependent on the level of purchasing power of the population, due to rising import prices, since 2014 the volume of imported fabric supplies (in physical terms) to the Russian Federation, the volume of production of domestic fabrics, as well as the market for textile products, began to decline.

Problems with production and sales have led to increased concentration of production in the industry. The process of consolidation of market players has intensified, accompanied by their consolidation - both horizontally and vertically. Textile products - yarn, fibers and fabrics are mainly used in further industrial processing. And only relatively small quantities reach the market as final products for retail sale. In parallel with this, the average number of employed workers decreased. Thus, in textile production from 2009 to 2021, the number of employees decreased from 146.9 to 100.6 thousand people. In the weaving industry, the number of people decreased over the same period from 60.9 to 24.3 thousand people.

The linen fabric market has an unreasonably low share in the structure of the domestic textile market. One of the reasons was competition with cotton products: domestic textile manufacturers are more willing to work with cotton fabrics, since they are cheaper than linen and the demand for them is higher. Linen fabrics are traditionally more expensive, which is associated with higher costs for raw materials and fabric processing. At the same time, flax prices are growing quite slowly. Due to the high cost of linen products, more than a third of the products of domestic companies are exported to the EU countries, the USA and Canada, where the income level is higher and linen products are in demand. The main exports are low-process linen fabrics; Dyeing and design of the canvas is carried out abroad.

The flax industry operates mainly on domestic raw materials (two-thirds of total production needs) and on raw materials supplied through tolling. At the same time, fabrics made from Russian fiber do not meet European quality standards, so purchasing flax fiber abroad is currently a necessary step in the production of quality fabrics to enter the attractive European and North American markets. Currently, there is a growing interest in the world market for textiles made from plant fibers (jute, flax, etc.), which requires great attention to the prospects of this segment. In particular, the government’s plans to organize a flax cluster in the Tver region have already been announced. However, in the linen fabric segment there is a reduction in consumption volumes, which occurs against the backdrop of a growing share of Russian-made products in the domestic market. At the same time, attention is drawn to the weakness of the export position of the industry, which has not yet been able to realize the potential of the weakening of the ruble that has occurred.

Against the backdrop of a reduction in production volumes, there is a steady trend towards a decrease in financial investments in fixed capital in the area under consideration. Only manufacturers of linen and semi-linen fabrics for special purposes . The key enterprises of the sub-industry under consideration include: LLC “Big Kostroma Linen Manufactory”, LLC “Krayteks-resurs”, LLC “Vyazemsky Flax Mill”, LLC “Yakovlevsky Flax”, OJSC “Trekhgornaya Manufactory”.

The volumes and share of exports of yarn and fabrics made from plant fibers remain unreasonably low. At the end of 2021, the share of these products in the total volume of textile exports was equal to 5.5%.

But initially flax production was very developed in Russia, based on its own raw materials. Currently, representatives of the Ministry of Industry and Trade have already announced the creation of a cluster for the production of linen textiles in the Smolensk region. The implementation of these plans should have a positive impact on the export of the corresponding type of product.

The basis of the Russian linen fabric market is domestic products. The largest Russian ones and LLC Flax Mill Tulma. The first of the companies mentioned above is in a state of bankruptcy and receivership has been introduced in relation to it.77 According to the statements of Vologda Textile OJSC, the company’s revenue for 2015 amounted to 79 million rubles, which is 33.5% lower than the result of the previous year. The situation is similar with, which is also in the process of liquidation and under receivership

Prospects for the textile industry

Since 2013, the state has been increasing its support for light industry. At the same time, the number of areas in which assistance is provided is constantly expanding. The main support measure remains subsidizing the costs that industry enterprises incur when taking out loans for their operating activities. To date, not only the financial participation of the state in the development of the industry has significantly increased, but also its direct control of the market configuration. Thus, the state clearly focuses the industry on synthetic products, providing priority subsidies to manufacturers in this segment, and places demand for synthetic textiles, acting as a consumer (orders from the Ministry of Defense, state corporations).

The industry has growth points associated with the production of synthetic fabrics. Russia initially has favorable conditions for the development of this particular segment of textile production, due to the presence of its own developed petrochemical production in the country. The state is actively involved in shaping the market, stimulating the development of synthetic products. On the one hand, the government directly subsidizes the industry. On the other hand, being a large consumer of products represented by structures under its control, the state quantitatively and qualitatively influences demand. At the same time, the drivers of growth in industry production in the coming years will be: the development of domestic production of synthetic fabrics and technical textiles; growth of the uniform and workwear segment; stimulated by state regulation in the clothing and home textile segments, the process of substituting imports with domestic products. True, the concern is that the growth in the production of synthetic fabrics is occurring against the backdrop of a steady decline in the production of their analogues from natural materials. At the same time, the production of synthetics does not fully replace the decrease in production volumes of natural fabrics.

When considering the prospects for the Russian textile industry over the next 5–6 years, it is necessary to take into account several factors that will be decisive for predicting its future parameters. Firstly, one of the main factors will be the state of the Russian economy as a whole. In accordance with the current forecast of the Development Center Institute of the National Research University Higher School of Economics, until 2024, the Russian economy will develop at an average annual rate of less than 2% annually. At the same time, the ruble exchange rate against the US dollar, which best reflects the state of effective demand in the Russian economy, will show a ratio of 60.9–86.9 rubles/dollar. throughout the entire period 2017–2024. That is, the growth of real wages will be limited during the same period of time at a rate of 2–3% per year. The combination of the above factors creates the preconditions for maintaining a low level of effective demand for textile products. First of all, this conclusion concerns the consumer demand of the domestic Russian market for the final product in the form of clothing and home textiles.

In this regard, government regulation and support measures have a significant impact. In recent years, government support for the industry has tended to constantly expand. In particular, according to the Ministry of Industry and Trade, in 2021 the volume of financing for light industry enterprises in the Russian Federation will increase by 40% compared to last year and amount to about 3 billion rubles. The results of 2021 show us that the Russian textile market did not just stop what was observed before Moreover, during the previous two years there was a rapid decline, but even showed an increase in the volume of apparent consumption. It is important to note that the growth affected not only domestic Russian production, which would be expected due to the ongoing and strengthened position of domestic enterprises in the market effect of the devaluation of the ruble, but also imports.

Based on materials: Butov A. M. Market of textile products, Development Center Institute National Research University Higher School of Economics, 2021 62 P.

Full text

History and prospects of the industry

In Russia, light industry enterprises were first opened in the 17th century. The basis was the production of cotton products. The work involved the use of machinery and civilian labor. Until the 19th century, there were cloth and linen manufactories working to help the state.

The industry's growth began to accelerate in the 19th century. At the end of the century, light industry determined the industrial development of the country. Many companies appeared throughout Russia, but the most important ones were located in large cities. During the Second World War, the sector suffered losses as many enterprises were destroyed. But still she provided the soldiers with uniforms.

After the war, the industry began to recover. In the USSR, products were exported to other countries. The USSR was in 2nd place in the creation of garments. In 1990, there was a decline in the production of goods as it was difficult to compete with many foreign manufacturers.

Now the textile industry is a developed sector, as its products are actively used for export. The products are competitive in comparison with products presented on the foreign market. The industry offers many jobs.

The textile industry is constantly developing, and it is an important industry in the state. This is due to its influence on the economic situation in the country. There is a rapid turnover of capital in this area, so there are no stagnations and other problems that may exist in other sectors of activity. Every year the situation in this area improves.

Major players

There are many enterprises producing textile products in Russia. The largest are the following:

- "Trekhgornaya Manufactory"

- BELASHOFF.

- Doctor Big.

- Kazan textiles.

- "Barakat-Tex".

- "Vasilisa."

- "VioTex".

- Borisoglebsk knitwear.

- Pavloposad shawl manufactory.

- Biysk Linen Company.

Other companies operating in this industry are presented in the Textile Factories section.

Each enterprise uses its own production technologies, resulting in unique products. All methods comply with quality and safety standards.

Technological processes

The fabric manufacturing procedure is carried out using special technology. All work is divided into stages:

- Yarn is created from fibers by processing them - loosening, fraying, combing.

- Textile threads are made from scattered cotton fibers.

- Production of materials on weaving machines.

- Finishing procedure. After this stage, the material acquires certain characteristics: strength, softness, smoothness, waterproofness.

These are just the basic rules for making materials. Depending on the type of fabric, the production process may have its own characteristics that are unique to it.